The telecommunications sector is one of the main pillars of a country’s economy and an important source of revenues. South Africa’s telecommunications industry is gaining ground in the continent and is rapidly catching up on the digital transformation wave.

Separate frameworks have guided the development of the telecommunications and postal services sector in South Africa since 1994. These include white papers on broadcasting policy, telecommunications policy and postal services policy. These policy frameworks focused on addressing historical inequalities in access to basic services, while ensuring that all South Africans benefit from new services and access to new technologies and that ICTs are actively used to meet the development goals of the country. These policy frameworks reinforced the constitutional principle of equality and equal access to all communication services by all South Africans.

The minister of telecommunications and postal services has established a 22-member ICT Policy Review Panel that recommends the best communications policy frameworks that will ensure that all South Africans take full advantage of the possibilities and opportunities created by convergence and digitization of communications technologies.

In the 1990s, South Africa launched its mobile operations, underwritten by Telkom in partnership with Vodafone. This subsidiary grew to be Vodacom, which Telkom sold in late 2008 in preference for its own 3G network. In 2004, the department of communications redefined the Electronics Communications Act, which consolidated and redefined the landscape of telecommunications licensing in South Africa (both mobile and fixed).

Today, there are four mobile operators in the country: MTN, Vodacom (majority owned by the UK's Vodafone), Cell C (75% owned by Saudi Oger), and 8ta, a subsidiary of Telkom. Other telecom players include Liquid Telecom, rain, in addition to other MVNOs and fixed internet providers.

Telecommunications in numbers

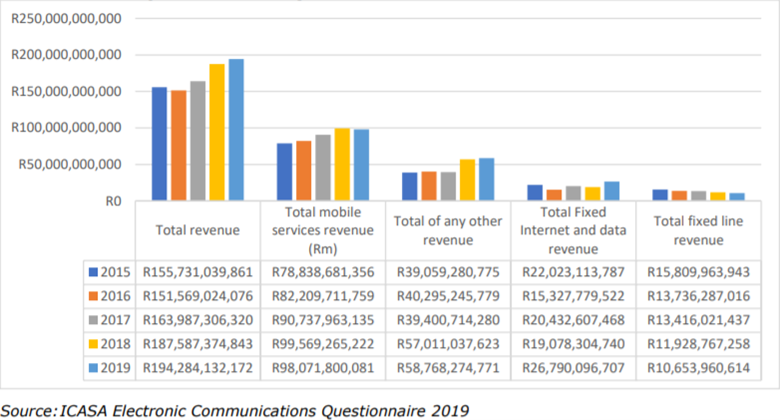

According to the annual report by the Independent communications authority of South Africa (ICASA), the total telecommunication revenue increased by 3.6% in 2019. Total fixed internet and data revenue increased by 33.2% and total mobile services revenue and total fixed line revenue decreased by 1.5% and 10.7%, respectively in 2019. Over a period of 5 years, total mobile services revenue and total of any other revenue increased by 5.7% and 3.1%, respectively. Total fixed internet and data revenue increased by 10.8% and total fixed line revenue decreased by 9.4% for the same period.

Total combined annual investment in the telecommunication sector decreased by 17.1%. Annual investment in mobile communication service and annual investment in fixed (wired)-broadband services decreased by 5.6% and 49.7%, respectively in 2019. Over a 5-year period the total telecommunication investment increased by 13.3%, Annual investment in mobile communication service increased by 3.7% for the same period.

As for mobile networks’ coverage, national population coverage for 3G increased from 99.5% in 2018 to 99.7% in 2019. National population coverage for 4G/LTE increased from 85.7% in 2018 to 92.8% in 2019. In addition, smartphone penetration increased from 81.7% in 2018 to 91.2% in 2019.

Mobile cellular data subscriptions increased by 18.8% from 65 million in 2018 to 78 million in 2019. In contrast, the total number of fixed line subscriptions decreased by 38% from 4.4 million in 2018 to 2.7 million in 2019. In 2019, analogue fixed-telephone lines decreased by 60.8%, ISDN voice-channel equivalents decreased by 2%, VoIP subscriptions increased by over 100%, fixed public payphones decreased by 1% and fixed wireless local loop subscriptions also significantly increased by over 100%.

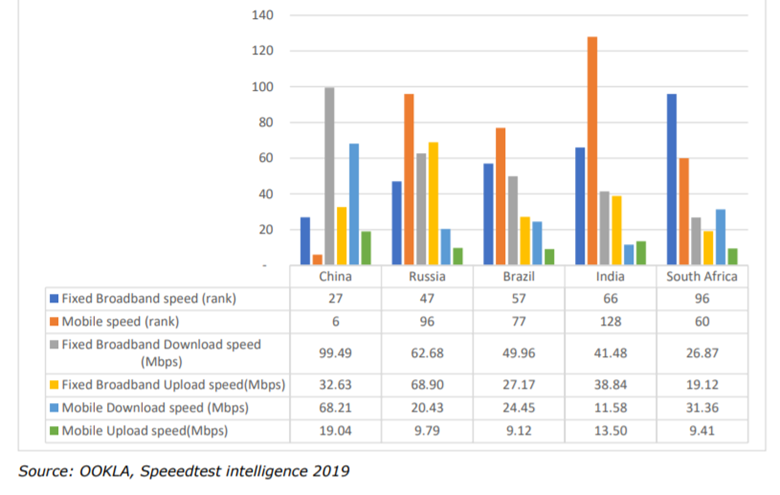

When compared to other BRICS countries, South Africa’s speedtest ranking for fixed broadband was at 96 (which is the lowest ranking in the grouping). South Africa’s speedtest ranking for mobile broadband was the second best in the BRICS grouping at 60 (only surpassed by China with a ranking of 6).

Digital transformation

Digital transformation is not as easy as it seems. South Africa has embarked on its digital transformation journey, somewhat slowed down by different challenges. In 2012, the country elaborated the National Development Plan 2030 (NDP) considered as a roadmap to achieve development through ICT. Chapter 4 of the NDP stipulates “Establishing a national, regional and municipal fiber-optic network to provide the backbone for broadband access; driven by private investment, complemented by public funds required to meet social objectives. 30. Change the regulatory framework to ensure that Internet broadband capacity improves, prices fall significantly and access improves.”

Since 2012, South Africa has been striving to achieve this mission. There has been considerable investment from Telkom, Liquid Telecom South Africa, Broadband InfraCo and municipal providers as well as from mobile network operators all aimed at improving network capabilities. The focus in recent years has been on backhaul capacity and on fiber and LTE networks to extend and improve internet service connectivity. With the ongoing migration to fiber, the incumbent telco Telkom expects to close down its copper network in 2024.

“With emerging technologies such as the Internet of Things, mobile financial services, we are leveraging innovation to address poor healthcare, education, financial exclusion and the digital divide, so as to improve the lives of every citizen and help them achieve more,” says Vodacom South Africa Chief Officer for External Affairs, Taki Netshitenzhe.

However, a clear digital vision might still be missing in South Africa. For its report, “Digital Champions: How industry leaders build integrated operations ecosystems to deliver end-to-end customer solutions”, PwC’s consulting capability, Strategy&, surveyed 1,155 executives at global manufacturing companies in 26 countries including South Africa and asked them about their views on Industry 4.0 and digital operations. Based on the outcomes, PwC developed a digital maturity index to explore the role of frontrunners – the so-called ‘Digital Champions’ – and what distinguishes them to outpace their competitors.

What are the steps that can help a country become a Digital Champion?

- Conduct an internal ecosystem assessment and explore the art of the possible

- Define an ecosystem vision and value proposition

- Develop an integrated ecosystem concept and strategic partnership model

- Set up an ecosystem governance, investment, and decision board

- Build ecosystem capabilities with iterative design and implementation

- Harvest the value of full ecosystem integration and reinvest it in continued expansion

10% of global manufacturing companies were characterized as Digital Champions, while 66% say their leadership does not have a clear vision for the digital future.

Pieter Theron, PwC partner advisory services and head of Industry 4.0 South Africa, said, “Digital Champions, are noteworthy because they view digitization in ways that are far-reaching and aggressively innovative, well beyond automation and networking. It is disappointing to note that none of the manufacturing companies we surveyed in South Africa are Digital Champions and most fall into the Digital Novice category (the least digitally mature companies in the report).”

A growth opportunity

However, on the contrary, many South African countries have embraced digital technologies and are close to reaching the ultimate goal of digital transformation. South Africa, the country, for example, is a regional leader in the deployment of several emerging technologies, such as biometric data and payment cards to deliver social security, drones in mining, which helps keep it at the innovative edge. The country also has several facilitating factors that reinforce its strengths: on a continent that struggles with power outages, it has the lowest frequency of monthly outages among the countries studied; it has high digital transparency measures; and it was ranked 19th globally as a financial hub by the World Economic Forum, which also scored the country highly for having one of the most advanced transport infrastructures in the region.

By applying new technologies in several sectors including the traditional ones (mining, agriculture, financial services), the continent can become a technology hub within the region. In South Africa’s mining sector for example, sensors and devices were integrated into the usual tools and machinery used within an IoT network. This promotes a speedier analysis of data and increased efficiency.

In addition, according to Harvard Business Review, with 64% internet penetration, and broadband and mobile internet speeds below the global median, it is recommended that South Africa increases internet access to a broader cross-section of its population and improve the quality of the access; Digital payments capabilities must be made more inclusive and more widespread; creating digital businesses should be promoted; and including creative and multimedia skills must be prioritized.

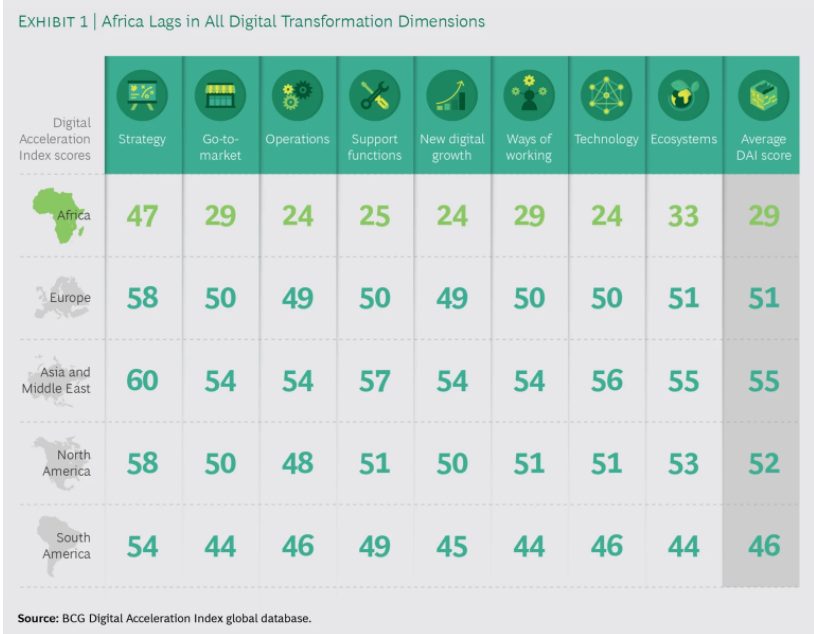

Knowing that Africa has potential in the digitization journey, however, it still lags digital maturity. Its digital infrastructure is still in its early growth stages. According to BCG’s assessment of companies’ digital maturity, as of 2018, only 30% of the continent’s population had internet access. Less than 40% of people in sub-Saharan Africa had smartphones, far fewer than in most other regions of the world. Digital skills lag as well, with Africa scoring 3.6 on the index used by the World Economic Forum, compared with 4.7 for Asia, 4.7 for Europe, and 5.5 for the US. This explains the average digital maturity score on BCG’s index of 29 out of 100 for companies on the continent, compared with 51 for Europe, 55 for Asia, and 49 for the Americas combined.

Following this analysis, the strong point for African businesses is in shaping digital strategies; whereas their weakness come in the executional categories with three main challenges: the first is from a strategic standpoint. Second, employee cultural resistance delays companies’ ability to scale up change. Third, lack of technical and human capabilities.

Africa got off to a slow digital start, but its adoption of digital technologies and capabilities is gathering speed. The markets’ history shows that experience is key for consumers and businesses to make their digital transition quickly, and incorporate it in their lives and operations. And with experience, they can accomplish it much faster than companies who build digital offerings from scratch.

Companies that have not begun their own digital transformation need to start now with as much initiatives as possible either from private or governmental sectors because who engages today could be reshaping the economy of 2030 for the greater good.